unified estate and gift tax credit 2021

The unified tax credit changes regularly depending on. This credit combines both gift taxes and estate taxes allowing you to mix and match according to your own gift-giving style.

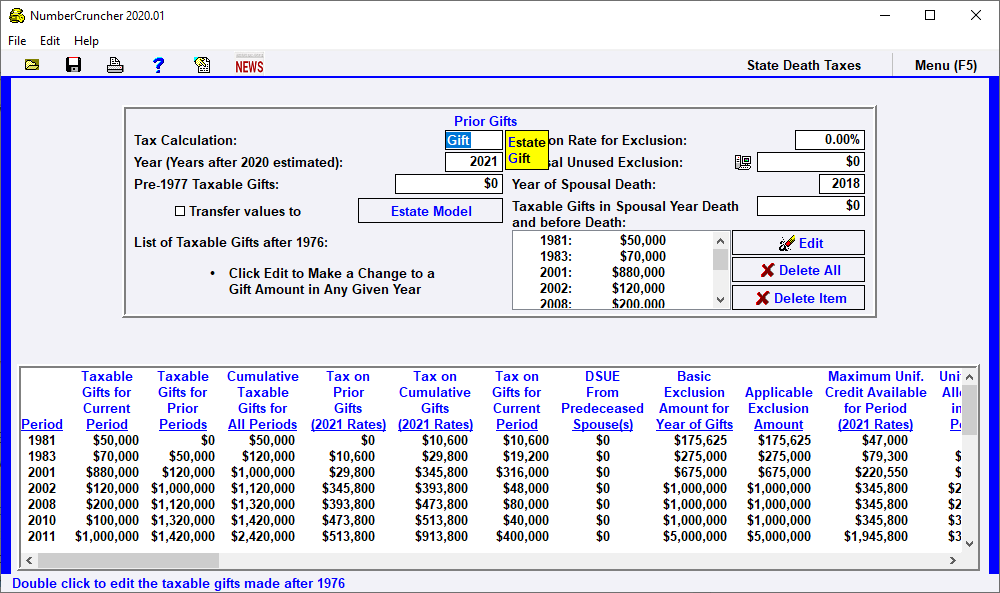

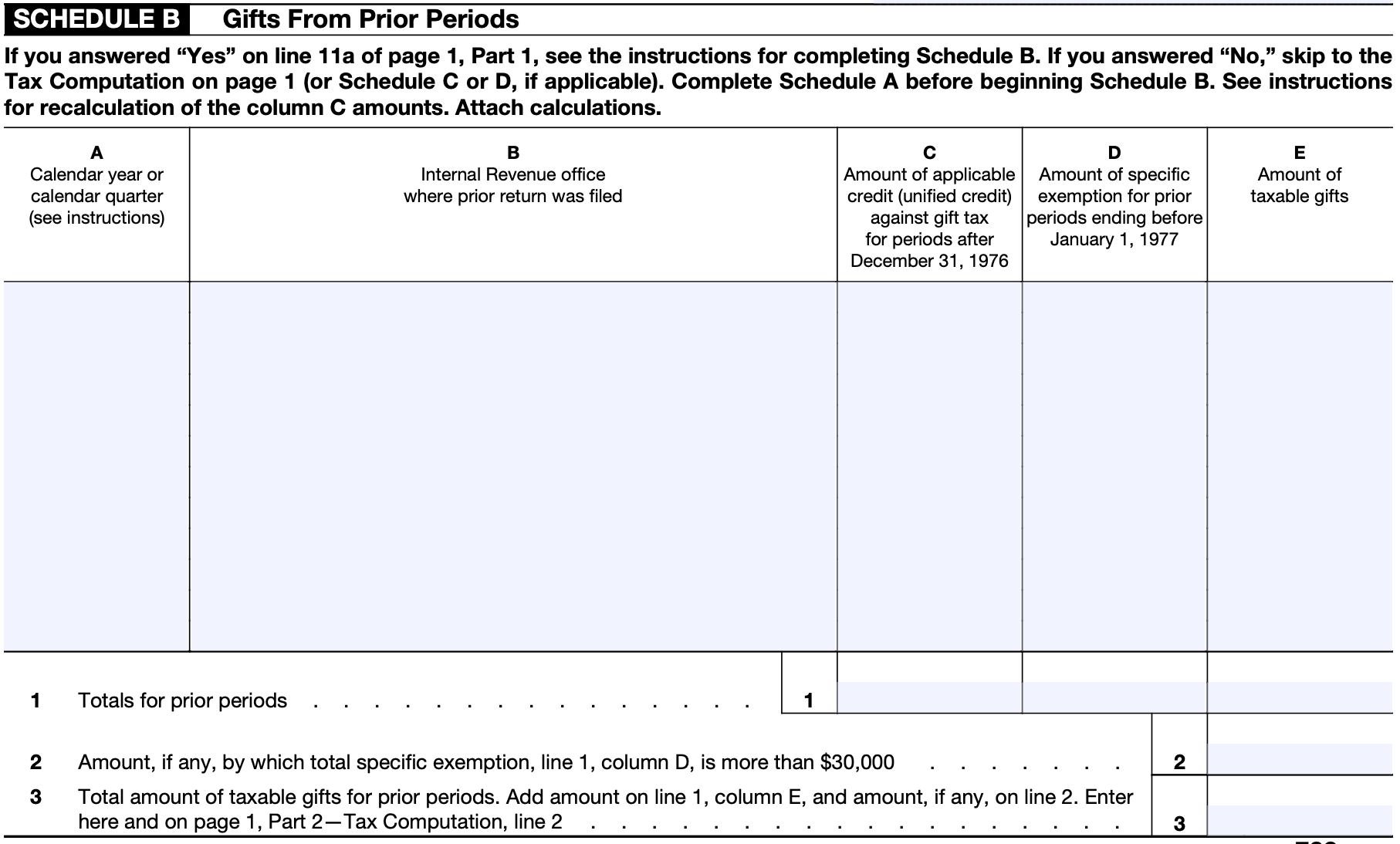

Prior Gifts Leimberg Leclair Lackner Inc

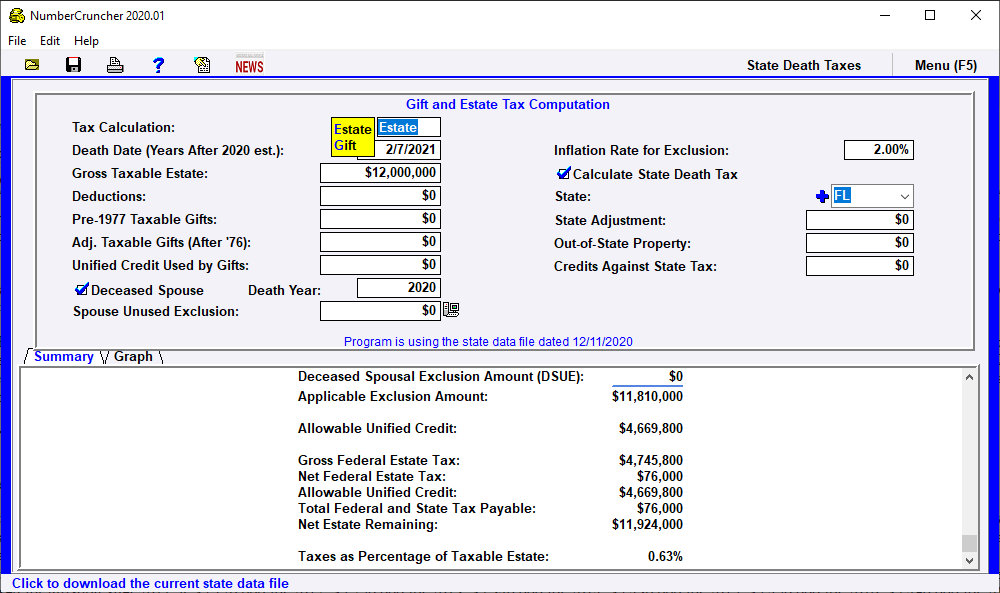

The unified credit limit was 117 million in 2021.

. The Internal Revenue Service announced today the official estate and gift tax limits for 2021. After the unified credit limit is reached the donor pays up to 40 percent on that. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

Wednesday January 20 2021 The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million. However this is set to expire in 2025 at which time. Starting January 1 2026 the exemption will return to 549 million.

The estate and gift tax exemption is 117 million per individual up from 1158 million in 2020. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. Any money gifted during your lifetime or after death above and beyond the cumulative unified credit amount of 117 million is subject to.

The Unified Tax Credit represents the amount of assets that an individual is allowed to gift to other parties without having to pay gift estate or generation-skipping transfer taxes. For 2021 the estate and gift tax exemption stands at 117 million per person. Any tax due is determined after applying a credit based on an.

This means that an individual is currently permitted. The unified tax credit is designed to decrease the tax bill of the individual or estate. The annual gift tax exclusion is 16000 for tax year 2022.

The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to. 1 You can give up to this amount in money or property to any individual per year without filing a gift tax return. For 2021 the estate and gift tax exemption stands at 117 million per person.

New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. This is called the unified credit. It also does not apply to any gifts that fall under.

As of 2021 the federal estate tax is 40 of the inheritance amount. What Is the Unified Tax Credit Amount for 2021. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

The gift tax limit for individual filers for 2021 was 15000. Overview On November 2 2017 in an unprecedented gesture of fiscal generosity Congress passed the Tax Cuts and Jobs Act and increased the federal unified gift and estate. When the gift tax.

The previous limit for 2020 was 1158 million. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate. Or of course you can use the unified tax credit to do a little bit of both.

Most relatively simple estates cash publicly traded securities small. Most every American taxpayer receives a lifetime credit against federal gift and estate tax of 12060000. The previous limit for 2020 was 1158 million.

For 2021 that lifetime exemption amount is 117 million. What Is the Unified Tax Credit Amount for 2022.

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Estate Planning Key Numbers Kirtland Federal Credit Union

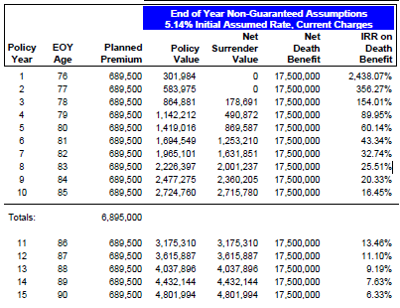

Solved Hello Ch Tutor Can You Explained This Assignment Thanks Course Hero

Do I Have To File A Gift Tax Return Jmf

A Simple Solution To The Estate Gift Tax Quandary Agency One

Estate Tax Bb R Inc And Buckman Advisory Group Llc

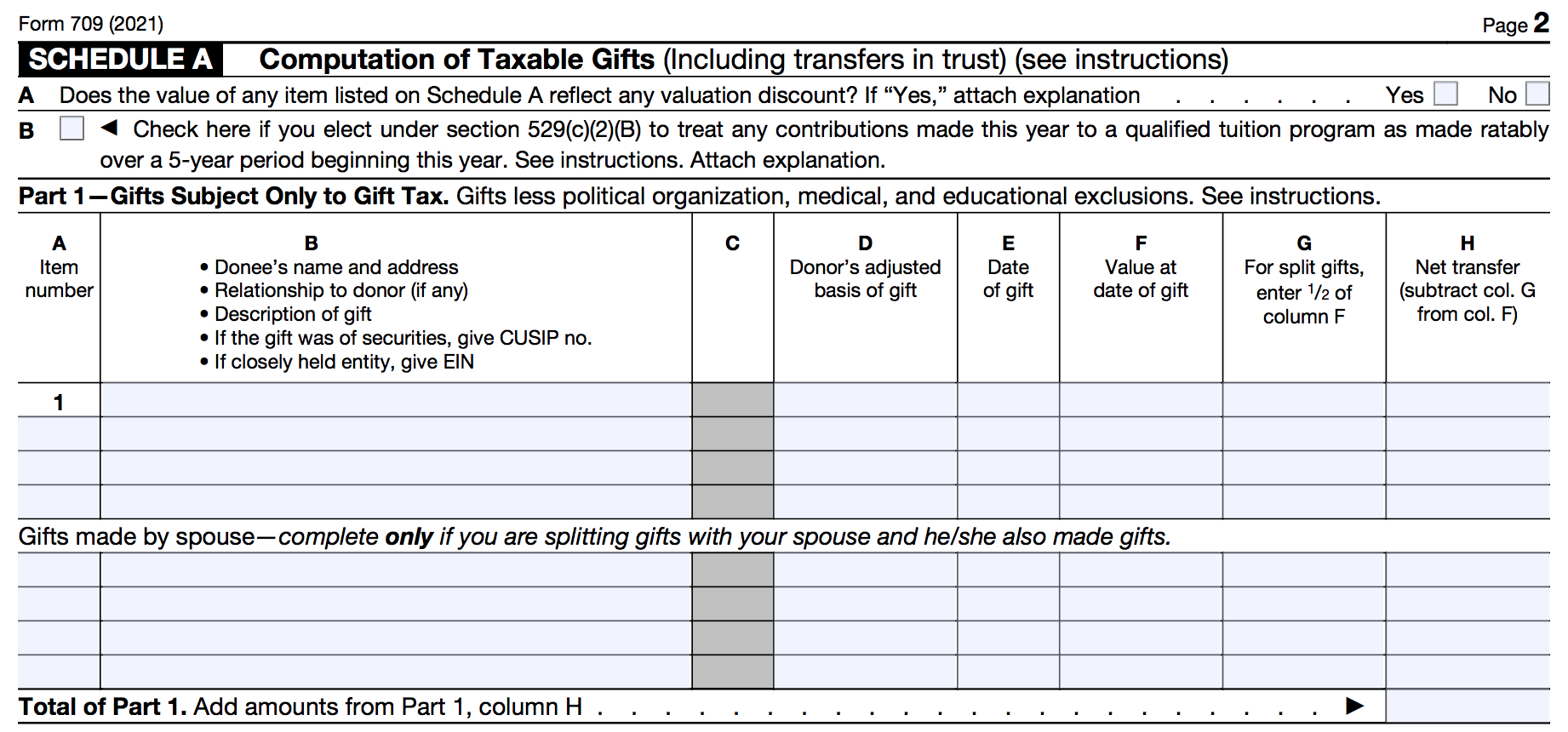

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Understanding How The Unified Credit Works Smartasset

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

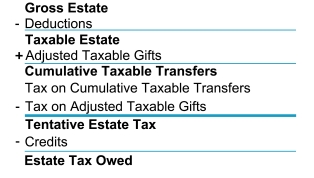

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

A Guide To Estate Taxes Mass Gov

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Gifting Time To Accelerate Plans Evercore

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center